Despite (the lack of?) news of Bitcoin hitting all time highs to $110k, things corrected quite a bit when Trump fought back on rumors that he did not have tariff controls. Outside of macro events, May marked a month of companies replicating Strategy’s well, strategy, of becoming Bitcoin holding companies. The way it works is if the company is declining in value due to slow revenue, it can use its capital or even its own equity value to buy more Bitcoin to peg more of its market valuation to that instead.

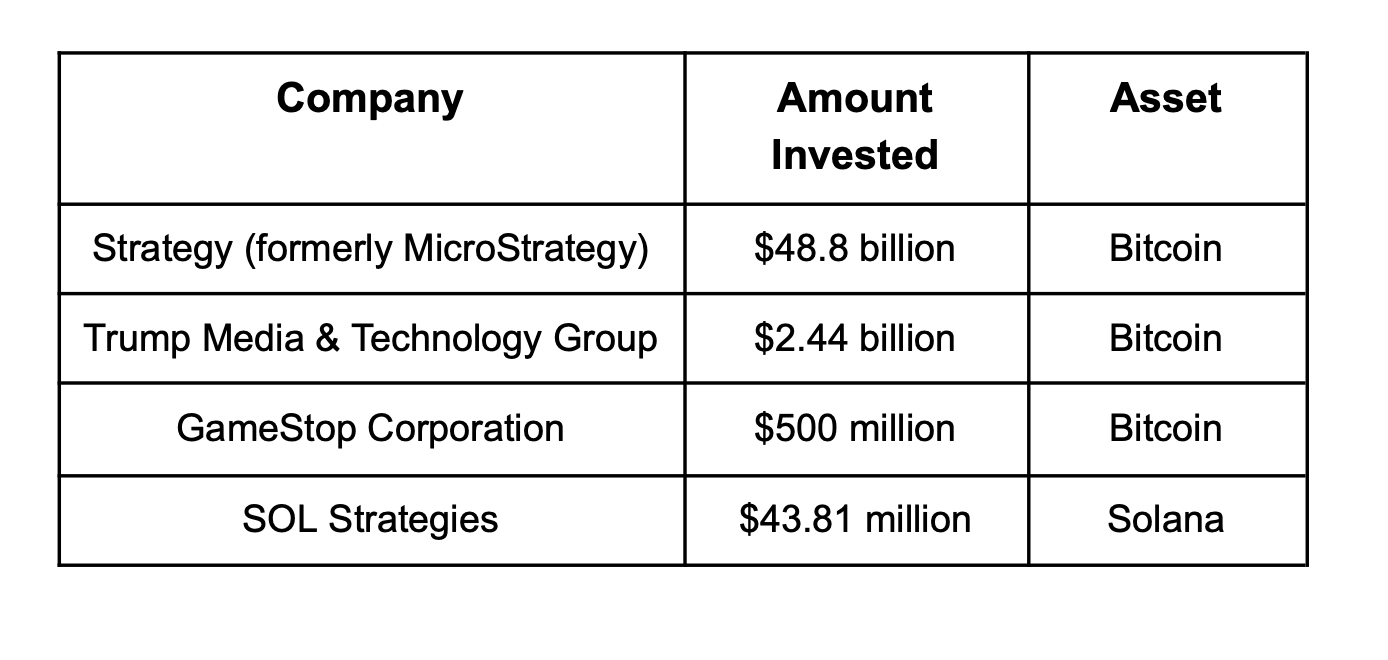

Recently there have been other companies replicating this, in May, we had Trump Media (DJT), owners of Truth Social and Truth.Fi, complete a treasury deal to purchase $2.44B in Bitcoin. Also Gamestop has acquired $500M worth of Bitcoin as well. Take a look at where a lot of companies stand with crypto holdings recently:

Not everybody is happy with this though, last week Meta rejected the idea of buying Bitcoin with only 0.1% of the votes in favor. They are also holding $72b in cash...

Meanwhile, the official Bitcoin conference was just held in Las Vegas. JD Vance was a big speaker there, saying that Bitcoin was a strategic asset against China, though I’m not really sure if that makes sense. Reform UK Leader and Pakistan’s Ministers both said they will establish a National Bitcoin reserve as well. And while we’re on the topic of politics, Vivek Ramaswamy’s firm, Strive Asset Management, is looking to acquire Bitcoin as well, starting with Mt. Gox holders, with a new $750M cash pile.

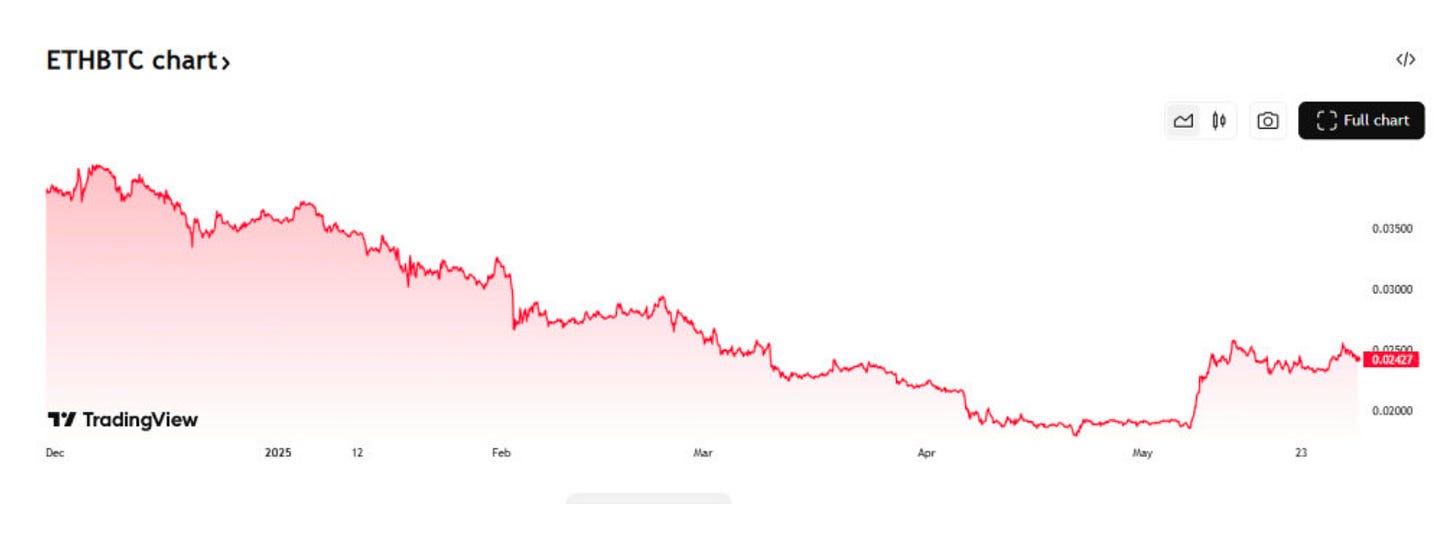

All in all, the direction does seem like more entities acquiring Bitcoin, not less. There is only so much BTC out there so we expect the price to continue trickling up. On any dip there are likely a lot of buyers waiting to pull the trigger, but remarkably, the ETH/BTC ratio chart is showing Ethereum is catching up again this month after 5 months of declines: